In today’s rapidly evolving financial landscape, digital payments and electronic transfers dominate conversations about business transactions. Yet, despite the surge in online banking, business cheques remain a vital payment method for many organizations worldwide. They provide a reliable, secure, and professional means of managing financial obligations, especially when dealing with vendors, contractors, and payroll.

This article explores what business cheques are, their benefits, types, and why they remain relevant for companies of all sizes.

What Are Business Cheques?

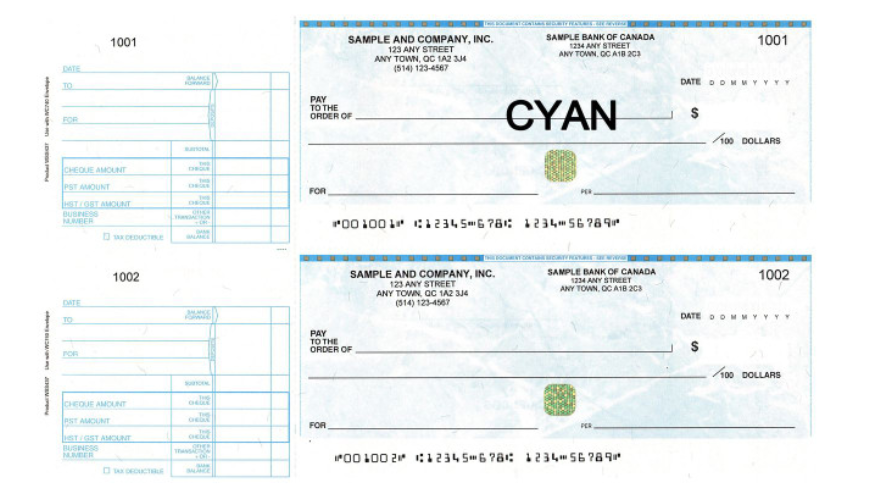

Business cheques are payment instruments issued by companies to transfer funds from their business bank accounts to a payee. Unlike personal cheques, business cheques are designed to meet corporate needs, often including customization options such as company logos, addresses, and branding.

Typically larger than personal cheques, business cheques also come equipped with security features to prevent fraud. These cheques are used not only for routine payments but also as a means to maintain precise financial records and ensure payment accountability.

Why Do Businesses Still Use Cheques?

Despite the convenience of digital payment platforms, many businesses continue to use cheques because:

1. Financial Control and Tracking

Writing a cheque requires deliberate action and authorization, providing a clear paper trail. This physical documentation helps in managing cash flow, budgeting, and reconciling accounts during audits.

2. Security

Business cheques incorporate anti-fraud features such as watermarks, microprinting, and tamper-evident inks. Physical cheques require signatures and are harder to alter without detection compared to some digital payment methods.

3. Vendor Preferences

Certain suppliers, especially smaller or traditional businesses, may prefer or require payment by cheque. Some jurisdictions or industries mandate cheque payments for compliance or record-keeping purposes.

4. Professionalism

Custom business cheques with company branding reinforce professionalism and credibility in financial transactions.

5. Audit and Legal Compliance

Cheques provide an auditable paper record, which can be essential for tax filings, regulatory compliance, and legal documentation.

Types of Business Cheques

There are several types of business cheques tailored to different company needs:

Manual Cheques

These are physical cheque books used for handwritten payments. Suitable for companies with low cheque volume or occasional payments, manual cheques offer flexibility but can be time-consuming and prone to human error.

Laser or Computer Cheques

These cheques are printed directly from accounting software such as QuickBooks, Sage, or Xero. Ideal for businesses with frequent payments, they automate cheque generation and allow for batch printing, saving time and improving accuracy.

Voucher Cheques

Including detachable stubs or vouchers, these cheques provide detailed payment information to the payee and serve as internal records for the business.

Blank or Business-Style Cheques

Some businesses prefer ordering blank cheques that they can print on demand with variable data using specialized printers or software.

Key Features of Business Cheques

- Customization: Most cheque printers allow businesses to add logos, company names, addresses, and other branding elements.

- Security Measures: Features like microprinting, holograms, watermarks, chemical-sensitive paper, and magnetic ink character recognition (MICR) codes are standard for business cheques.

- Compatibility: Business cheques are designed to work with accounting software and printers to streamline payment processes.

- Size and Format: Generally larger than personal cheques, they may be printed in various formats such as top, middle, or bottom cheque placement on standard letter-sized paper.

How to Order Business Cheques

Ordering business cheques involves several considerations:

- Choose a Reputable Supplier: Select a cheque printer authorized by your bank and compliant with security standards.

- Verify Bank Details: Ensure your bank account number, routing number, and company name are accurate.

- Select Cheque Type and Format: Based on your printing method and software compatibility, choose manual, laser, or voucher cheques.

- Add Security Features: Prioritize cheques with anti-fraud protections.

- Customize Your Cheques: Incorporate branding elements to reflect your company’s identity.

- Plan for Volume: Order enough cheques to meet your payment schedule, considering potential bulk discounts.

Best Practices for Managing Business Cheques

- Limit Access: Only authorized personnel should handle cheque books or printing.

- Secure Storage: Store unused cheques in a locked, secure location.

- Reconcile Regularly: Conduct frequent bank reconciliations to identify discrepancies promptly.

- Use Sequential Numbering: Prevent fraud by monitoring cheque numbers.

- Void and Dispose Properly: Shred voided or unused cheques to avoid misuse.

The Future of Business Cheques

While electronic payments continue to grow, business cheques maintain a significant role, especially in industries and regions where traditional payment methods are preferred. Many companies use a hybrid approach, combining digital payments for speed and cheques for detailed documentation and control.

Cheque printing companies are also innovating by offering more secure, customizable, and software-integrated cheque solutions to meet evolving business needs.

Conclusion

Business cheques remain a reliable, secure, and professional payment tool for companies worldwide. By providing a physical payment record, enhancing control over expenditures, and maintaining vendor relationships, cheques complement digital payment methods in a well-rounded financial management strategy.

Whether your business is large or small, incorporating business cheques into your payment systems ensures greater transparency, accountability, and peace of mind in your financial transactions.